“Sustainability is now an integral mechanism for change. More than ever before the focus on reduction, waste, accountability and gender equality are the staple requirements for a successful business.” - Lee McGhie, Director of Sustainability, Brownlow Utilities

Brownlow's sustainability team will help businesses understand the existing and new sustainability obligations launched under the recent #COP26 gathering in Glasgow, providing insight, strategic planning and competitive advantage.

A proven suite of sustainability services will guide your business on the road to Net Zero enabling you to;

*GHG - Greenhouse Gas

There are several governmental schemes in place to drive the legislation, all helping businesses reduce energy consumption and costs whilst improving efficiency and the environment.

Climate Change Agreements (CCA) – Allow eligible energy-intensive businesses to receive up to a 81% discount on gas and up to 92% for electricity on their Climate Change Levy (CCL) in return for meeting energy efficiency or carbon-saving targets

Streamlined Energy and Carbon Reporting Scheme (SECR) – is new legislation affecting all large UK undertakings from April 2019 who must annually report on their energy use, carbon emissions and efficiency measures

Energy Savings Opportunities Scheme (ESOS) – A mandatory European energy assessments and energy savings identification scheme for large businesses

Energy Intensity Industry Scheme (EIIS) – Schemes which compensate the most electricity-intensive industries in the UK for the impact of increased energy prices caused by renewable sources of energy

Contact a member of our Sustainability team for a chat today 01744 778530 (option 4) or email amanda@brownlowutilities.co.uk.

Strategic energy and Net Zero planning

20-minutes for a full energy contract tender

£8m costs recovered for our clients

Compliance for 3000+ businesses

25+ energy, water and carbon reports

Solar PV to become more sustainable and reduce carbon footprint

Carbon footprint exercise to drive their Net Zero journey

Providing financial reports with energy intelligence - SECR

Helping the charity to save over £9,000/year in water charges

Find convenient water savings following an invoice audit

Delivered great savings across a range of utility services

6 Figure Energy Savings for a large multi-site organisation within the food sector.

Renewal savings made with clarity and transparency.

Our clients save an average of 24% on utility costs.

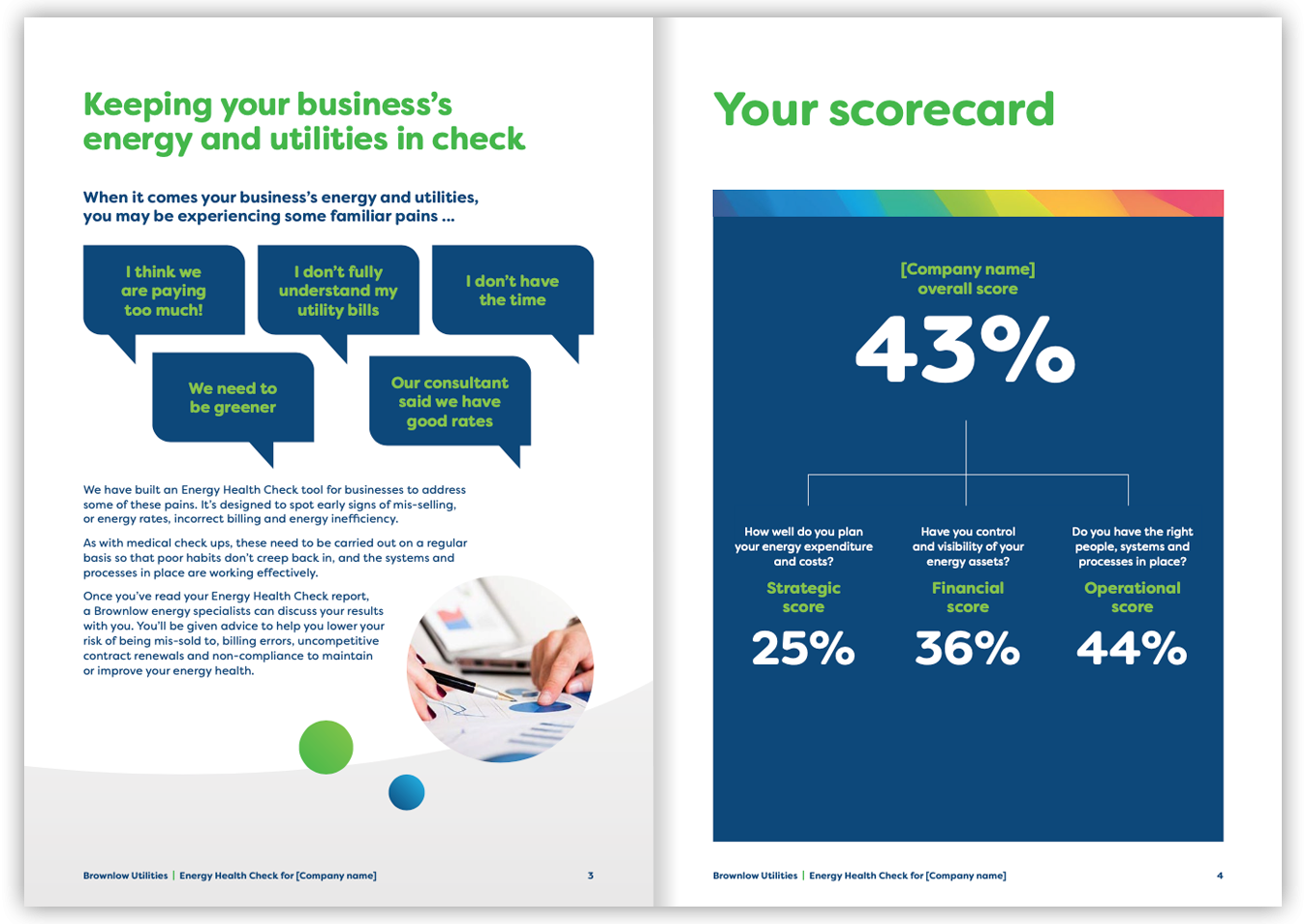

Get a free health check for your company.