Flexible purchasing explained

Luke Connelly

28th July 2020

Flexible, risk managed energy purchasing versus fixed

Many more businesses are buying their electricity and gas on a flexible, rather than fixed basis. The flexible purchasing of energy allows you to find an effective middle ground between having a long-term fixed contract and paying volatile day-ahead prices.

A fixed contract, while providing some financial stability, doesn’t allow your business to take full advantage of any downward market movements that are likely to occur over the contracted period.

Conversely, paying dayahead rates, while allowing you to take advantage of the market when it bottoms, provides no security should the market spike or if prices increase significantly.

A flexible contract, and our risk management policy, allows for you to reap the benefits of both. While a fixed contract will purchase 100% of your volume at a set price for your contracted period, a flexible contract allows for us to purchase and sell portions or tranches of your monthly volume, as far ahead as 4-5 years in advance, responding to market volatility and the upward or downward movements that are inherent in any commodity market.

Purchasing your volume before the price of energy looks to increase further (protecting your forward costs so that you’ll be paying less than you would otherwise) and selling or unfixing volume before the price decreases

further (seeking to repurchase the energy at a more favourable rate when the market has bottomed).

What does buying flexibly require?

- A greater understanding of a business’s appetite for risk and purchasing strategy

- A complex process behind it to ensure competitive, protective and secure purchasing

- Rigorous Tendering Exercise

- Evaluation of supplier offers on qualitative and quantitative terms

- Manage purchasing in conjuncture with our Value at Risk (VAR) model.

- Analysis using live gas and electricity market feeds

- Portfolio of reports showing position, progression, budget forecasting

Our Value at Risk (VAR) model

Our Value at Risk (VAR) model works alongside the flexible purchasing model, being tailored to your business needs and risk strategy. It is a methodology used in investments and the purchasing of a vast array of other

tradable commodities. Applying this model to your energy contract allows for us to protect your energy spend position against any potential price increases, whilst also providing the potential to better the price you’ll be

paying for your gas and electricity.

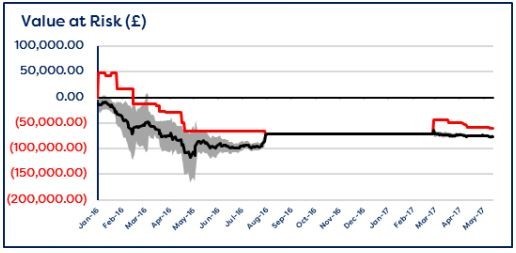

As you can see in the image above, we track the Capital at Risk line (RED) alongside the Position Value (BLACK). This Capital at Risk line represents the amount of risk that you are prepared to authorize to give your business the opportunity to benefit from falling prices. The Capital at Risk line also acts as an upper ‘price cap’, ensuring that purchases are made when prices begin to increase, thus protecting your positions from further rises.

We will consult with yourselves as and when to move the risk line downwards/upwards to an agreed level above the position value, taking risk out of the market or opening more risk to allow for increased opportunity to take advantage of falling prices.

Get in touch with our Energy trading team trading@brownlowutilities.co.uk.