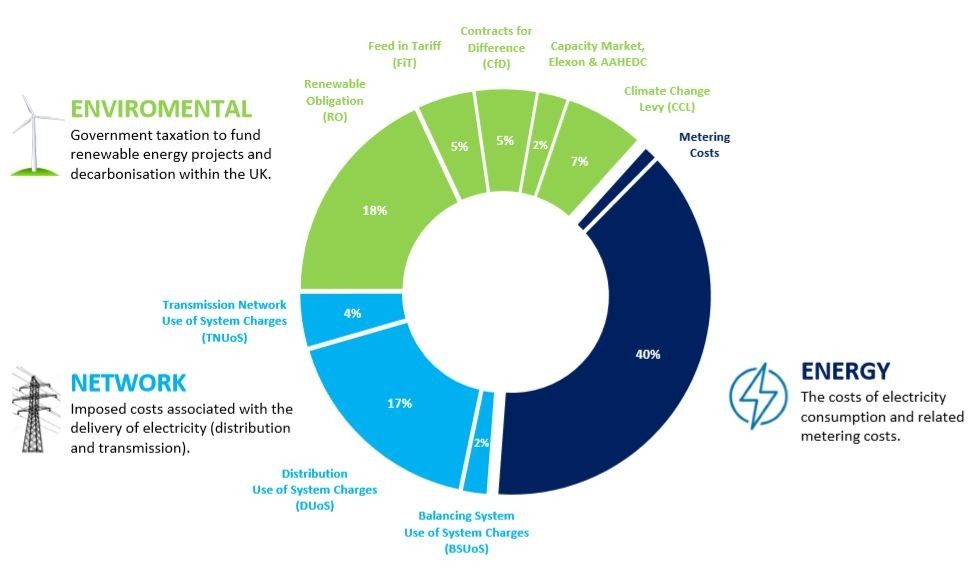

Electricity Regulatory & Third Party Charges

Luke Connelly

3rd September 2020

The financial burden of COVID instigated lockdown remains. In response, many businesses, Government bodies and other institutions are pushing back decisions, targets and activities. In this respect, the energy industry is no different. Targets still exist to push the UK’s economy towards a brighter, greener future and in order for those targets to be met, the funds must exist.

Alas, given the nature of the global and UK response to the virus, these funds haven’t been generated.

So what does this mean for your business' energy?

Businesses can expect a rise in all non-commodity elements/green taxes in particular due to this under-recovery. These elements are shown in the pie chart and explained in more detail below.

In summary;

- Flexible and Energy only contracts - should expect to see increases for a couple of charges almost immediately and then gradually over the next two years.

- Fixed price contracts– should start to see:

- a rise in tendered costs henceforth – due to the increasing tariffs and general business uncertainty; and,

- ad hoc recovery charges on invoices, for the likes of BSUoS, FiT, CfD etc., even for fully delivered contracts

How can you reduce the impact of these charges?

- REDUCE - In order to reduce these charges, you will need to reduce your electricity consumption. Look at ways to manage your electricity load, minimise usage during peak (RED) periods, avoid Triad charges.

- REVIEW - Consider ways to become more energy efficient. Look at techniques and technologies that can help you manage your energy better

- RENEW - Take a look at renewable energy generation and the various funding options that are now available whilst offseting your carbon footprint.

- REGULATE - You may eligible to receive exemption from some of these charges depending on your business nature and its processes.

SUMMARY OF KEY CHARGES AND EXPECTED CHANGES

GREEN TARGETS

The net-zero carbon commitment target has been particularly highlighted as achievable during COVID-19’s imposed lockdown. With energy consumption hitting unprecedently low levels, emissions have followed suit and the Government is now aiming to use this period of time as an opportunity to build towards a ‘green recovery’.

The Committee on Climate Change Report have targeted the building of or investment in:

Low carbon retrofits across the country.

- Tree-planting.

- The ‘strengthening of energy networks’.

- Improved infrastructure to enable increased home working.

- A move towards a more circular economy, with increased recycling and onsite generation as particular examples.

COST/TARIFF CHANGES

As economically and socially beneficial as these targets are for the UK, they do cost money. With a number of green tax schemes under-collecting – as a result of the country under-consuming – the revenue streams don’t exist to fund these projects currently. Hence, the following non-commodity increases are likely to occur:

Feed-in-Tariff & Contracts for Difference (Fit & CfD)

Dept of BEIS (the Government body who administer the scheme) had chosen to defer some of these increases, rather than hit businesses with increased rates during the middle of lockdown. Now that we’re coming out of economic lockdown you can expect to see rate increases, in particular during Q2 21 (12 months after onset of COVID-19 and the start of a new financial year)

BSUoS

BSUoS experienced particularly high operational costs for the Summer period due to the low national demand levels and the influx of supply at the time.

Additionally, they had to pay increased compensation payments to renewable generators for generated electricity that couldn’t be consumed or injected into the grid.

The industry proposed to defer the c. £500m undercharge until April 2021 but OFGEM rejected this. They have, however, capped BSUoS at 1.5p/kWh, a huge increase from the usual 0.2-0.3p/kWh rate we usually see.

Not that the BSUoS charging mechanism is planned to change in April 2021, with the view of administering the charge as a

As neither BSUoS nor CfD/FiT rates are published prior to the period of consumption, they can administer rate increases when necessary.

Renewables Obligation (RO)

The RO rate will likely increase from Q2 21 onwards, with the current rate of 2.3751 published and in place until the end of Q1 21.

DUoS/TNUoS

OFGEM agreed to extend payment terms for energy suppliers in paying their collected network charges. This was done in particular to help smaller energy suppliers continue to operate.

Due to the fact that DNOs have published charges as far ahead as March ’22, they will not be able to recup any under collection until April 22, at which point we’d expect them to implement tariff increases across Red, Amber and Green rates, as well as for ASC charges and standing charges.

In aiming to change the TNUoS demand charge into a flat charge, invoiced throughout the year, they had initially targeted April 21 for roll-out. This has been put back until April 22, with the charging mechanism reverting from the current TRIAD method to a p/kWh or kVA associated charge.

Give your Account Manager a call or 'Book a Call' if you would like to discuss any of the above.

With years of business energy management experience, we can advise on ways to minimise the effects of these charges whilst helping to reduce your carbon footprint.